VAT Identification Numbers: Understanding their Importance, Structure, and Application

Value Added Tax, or VAT Identification Number, forms an important part of the tax structure of most countries, especially within the European Union. It is a unique number that is quite essential for any business registered for value-added taxes, ensuring compliance and efficiency in domestic and cross-border transactions. In this fully elaborate guide, we are going to discuss the importance of a VAT Identification Number, the structure of the code, how it works, and what it really means to businesses and consumers.

What is a VAT Identification Number?

A VAT Identification Number, also commonly referred to as simply VAT ID, is a unique code assigned to businesses and organizations registered in the collection and remittance of Value Added Tax. It plays a very important role in the whole administration of taxes because, through it, tax authorities are able to track tax obligations, and hence it ensures that businesses comply with the regulations concerning VAT. The VAT ID plays an indispensable role in businesses that are engaged in the supply of goods and services subject to VAT, especially where different taxing jurisdictions are concerned.

Importance of VAT Identification Numbers

- Legal Compliance: It is imposed on the part of the law on every company whose turnover surpasses a particular threshold or arises from cross-border transactions. In that way, companies would not breach VAT legislation and would thus avoid fines and legal hurdles. Lack of ability to provide the VAT ID may hence lead to audit, fines, and even restrictions on one's business activities.

- Business Credibility: A VAT ID on an invoice and receipt lends credibility to the business. This means your business is duly registered for a VAT ID, helping in gain confidence and professionalism in all transactions. The VAT ID also assures the stakeholder that the business is within the legal ambit of the law regarding taxation and that it is compliant with financial regulations.

- Cross-Border Trade Facilitation: In international trade, a VAT ID becomes crucial for the smooth facilitation of transactions with suppliers and customers overseas. It eases cross-border trade to simplify the complexity of facing various VAT regimes. With the effectiveness of such a VAT ID, companies shall avoid double taxation complications and make sure proper VAT treatment is accorded.

- VAT Recovery: The VAT system allows the refund of VAT paid on purchases by registered businesses. A VAT ID becomes necessary for claiming such refunds. Thus, it becomes an important aspect of cash flow management. Recovery of VAT would help reduce the cost and thereby increase profitability for the businesses.

VAT Identification Number Structure

The structures of the VAT Identification Numbers are different in every country; most of them follow a certain pattern, though. In the EU, the VAT ID usually starts with a two-letter country code, followed by numbers. Each member state lays down the format rules in its own way.

Sample Formats

- European Union:

- Germany: DE123456789

- France: FR123456789

- Italy: IT12345678901

- United Kingdom: VAT ID: GB123456789

- Ireland: VAT ID: IE1234567GA

Key Elements

- Country Code: The two-letter code identifies the country of origin of the business. Furthermore, the tax authority uses it to facilitate follow-up and ensure various VAT responsibilities in other countries.

- Numeric Code: A specific number assigned to a company that may be supplemented by additional digits, depending on the respective national regulations.

How to Obtain a VAT Identification Number

- Determine Your Eligibility: First, businesses have to consider whether they are obliged to register for VAT. This usually entails the following:

- Turnover during the year is more than the limit for VAT registration.

- Intra-EU supplies.

- Importation of goods from outside of the European Union.

- Prepare the Documentation: These applications are usually accompanied by numerous documents that include but are not limited to:

- Evidence of incorporation such as a Certificate of Incorporation.

- Tax identification numbers.

- Financial statements or estimated turnover to prove their eligibility.

- Fill Out the Application: This can be done by applying for a VAT ID through the local tax authority. Most of these applications are online, but processes might differ in various countries. In filling up the application form, careful attention should be paid to the fact that all information provided is proper to avoid any setbacks in its processing.

- Approval: Then, a tax authority will review the application once it is submitted. Once approval is provided, the identified businesses are issued their VAT Identification Number for inclusion on their invoices and any other VAT-related transactions. When approval may be considered timely is not certain, and businesses will need to plan accordingly.

Use of the VAT Identification Number

- Invoicing and Receipts: About invoicing, there is a requirement for the inclusion of a VAT ID. The important thing about this is compliance with the law and transparency in every type of financial transaction. This will make the customers aware of whether they have to go for VAT reclaiming or not.

- Cross-Border Transactions: In cross-border transactions within the EU, providing the VAT ID is crucial for proper VAT treatment. This prevents double taxation and ensures that correct VAT rates based on the destination of the goods or services are applied.

- VAT Returns: Each business has to report its VAT ID on every VAT return that it files with the concerned tax authorities. This will make it easy for any authority to trace several tax obligations easily. Besides, the chances of reclaiming eligible VAT by businesses are attained. The advantage of correct reporting is that it helps your business to stay compliant and in good books with all the related tax authorities.

Legal Consequences of Not Having a VAT Identification Number

- Legal Consequences: Operating without a VAT ID when required has severe legal consequences in the form of fines, penalties, and back taxes owed to tax authorities. All these factors seriously bring down the reputation of a business enterprise besides financial health, inviting further inspections by regulatory authorities.

- Cash Flow Problems: Without being able to reclaim VAT, it might mean cash flow difficulties for the businesses. It could mean reduced resources for operational and growth issues, which might further negatively impact overall business performance. Cash flow management is an important task in terms of maintaining sufficient liquidity for assured and sustained growth.

- Inability to Trade Internationally: This no VAT ID thus makes them unable to compete effectively in the international markets. In international transactions, various suppliers and customers may require a VAT ID so that the transactions can be correctly reflected. Such requirements make them act as trade barriers, hence limiting opportunities for market access.

VAT Identification Number and Consumer Protection

- Transparency: This means a VAT ID increases transactional transparency. As a consumer, they are certain that businesses are operating legally; they will most definitely be sure they are dealing with registered organizations, ones that abide by the laws of taxation. This protection secures a much safer buying environment.

- Consumer Rights: In many jurisdictions, a consumer has the right to request an invoice which should include a VAT ID. The right protects the consumer against incomplete documentation of purchases when they may be required to have warranty claims or returns. Clear invoicing practices help in building trust and satisfaction for any consumer.

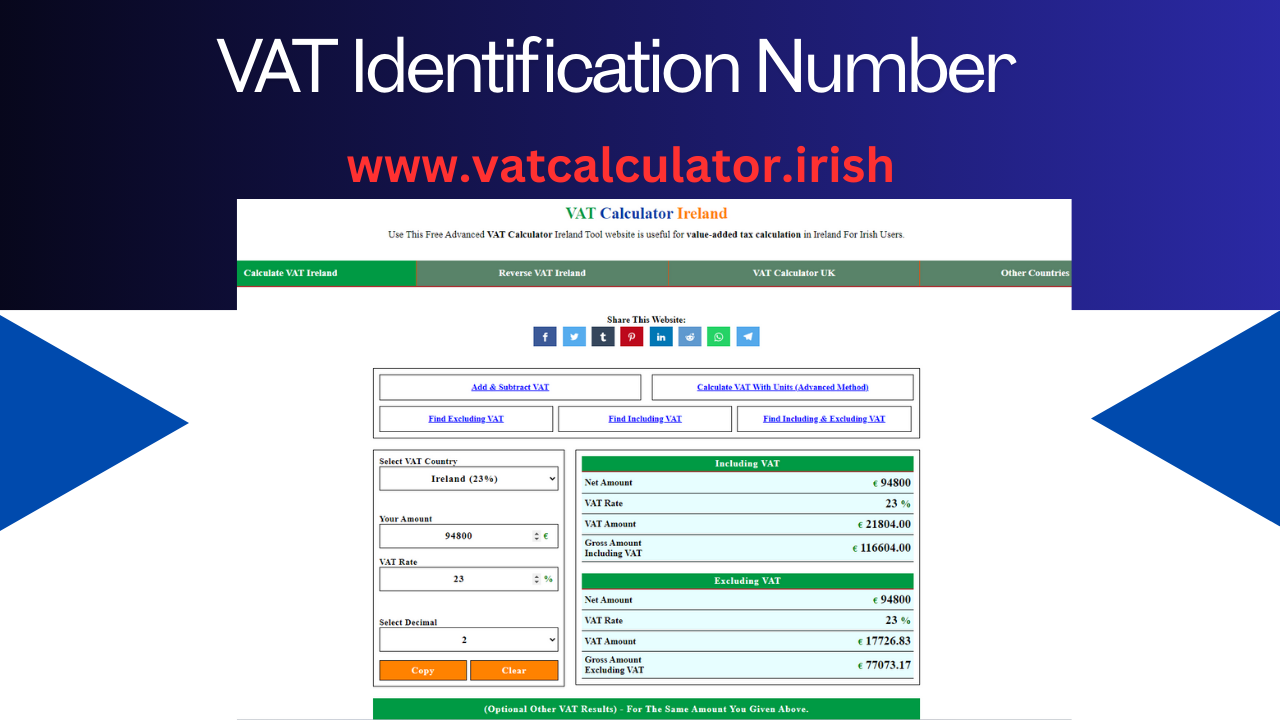

VAT Identification Numbers in Ireland

The VAT Identification Number in Ireland is in the format IE1234567GA, with "IE" being the country code and a unique sequence of digits after it. In Ireland, a business is obliged to be assigned a VAT ID when its taxable turnover is over the threshold set by the Revenue Commissioners-€75,000 for goods and €37,500 for services. A VAT ID number is an essential requirement to meet Value Added Tax laws in such a way that a business is not listed and is able to claim value-added tax on its qualified purchases.

What is more important to businesses involved in cross-border trade is the VAT identification number. It ensures smooth transactions within the EU and zero rating of intra-EU sales. Irish businesses should make sure that they add their VAT ID on all invoices and receipts for compliance purposes and to facilitate seamless trading with their counterparts across Europe.

Conclusion

A VAT Identification Number is the most indispensable part of the modern tax system, especially for all businesses involved within the European Union and countries using VAT. It brings ease about legal compliance and lends credibility to a business while smoothing out transactions across national borders. Thoroughly knowing how to apply and make use of a VAT ID is crucial to any business involved in VAT-liable activities.

Final Words on VAT Identification Numbers

With the changing face of the global economy, every business deals with VAT regulations and the importance of the VAT Identification Number. Good VAT management is about obligations for compliance but also about enabling the enterprise to be competitive in the market. If the organization pays close attention to VAT awareness and compliance, it will be better prepared to address the challenges of the tax world with confidence and will further enhance relationships with valued customers and partners.